Heterogeneous price and quantity effects of the real estate transfer tax in Germany

Zusammenfassung

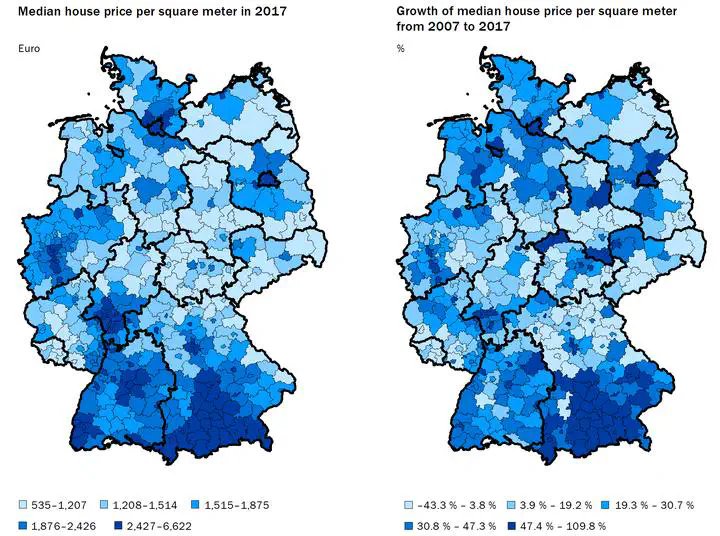

Using quarterly data for German counties, we study how housing prices and offers respond to higher transaction costs induced by tax increases. Since 2006, states can set their own tax rates on real estate transfers. Several and substantial tax hikes generate variation across time and states which we exploit in our empirical analysis using an event study design. Our results indicate that prices and offers decrease significantly by 3% and 6% already in the quarter in which the tax increase is announced in press but rise subsequently. Furthermore, we find heterogeneous responses when distinguishing between different types of counties. Housing prices decrease persistently in shrinking counties, while this is at most temporarily the case in growing, central and peripheral counties. This implies that the economic incidence of this tax varies across transactions.